Smart shoppers know that auto insurance companies don’t want their customers to go rate shopping. Drivers who perform rate comparisons will, in all likelihood, switch companies because there is a significant possibility of finding more affordable rates. A study showed that consumers who did price comparisons regularly saved $70 a month compared to drivers who never compared prices.

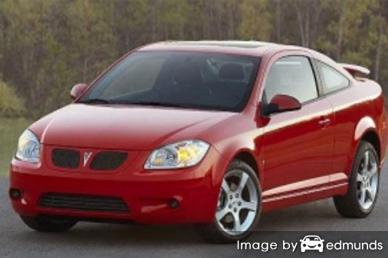

If saving money on Pontiac G5 insurance in Columbus is your ultimate objective, understanding how to find and compare cheaper coverage can help make the process easier.

To save the most money, the best way to get discount Pontiac G5 insurance is to regularly compare prices from insurers who provide car insurance in Columbus. Rates can be compared by following these guidelines.

To save the most money, the best way to get discount Pontiac G5 insurance is to regularly compare prices from insurers who provide car insurance in Columbus. Rates can be compared by following these guidelines.

- Take a little time to learn about how your policy works and the things you can change to keep rates low. Many factors that cause high rates such as traffic tickets, fender benders, and your credit history can be remedied by making minor changes in your lifestyle. Read the full article for tips to get cheaper coverage and earn a bigger discount.

- Request price quotes from exclusive agents, independent agents, and direct providers. Direct companies and exclusive agencies can only give rate quotes from one company like Progressive or Farmers Insurance, while independent agents can provide rate quotes from many different companies. Compare rates

- Compare the quotes to your current policy premium and determine if cheaper G5 coverage is available in Columbus. If you find a better price, ensure coverage does not lapse between policies.

- Provide adequate notice to your current company of your intent to cancel your current coverage and submit the signed application along with the required initial payment to the new company. Once the paperwork is finalized, store the certificate verifying proof of insurance in a readily accessible location in your vehicle.

An important note is that you’ll want to compare the same liability limits and deductibles on each quote request and to quote with as many carriers as you can. This guarantees an accurate price comparison and and a good selection of different prices.

Buying affordable insurance in Columbus is not that difficult. Essentially every car owner who shops for insurance will most likely find a better price. Although Ohio consumers can benefit by having an understanding of the way insurance companies charge you for coverage because rates are impacted by many factors.

Companies offering Pontiac G5 insurance in Ohio

The companies shown below offer quotes in Columbus, OH. If multiple companies are listed, we recommend you visit as many as you can to find the most affordable auto insurance rates.

Affordable Columbus car insurance rates with discounts

Insurance can be prohibitively expensive, but there are discounts available that you may not know about. A few discounts will be applied when you complete an application, but a few need to be asked for in order for you to get them. If they aren’t giving you every credit possible, you could be paying more than you need to.

- Early Signing – Some companies provide a discount for switching to them before your current coverage expires. You can save around 10% with this discount.

- Defensive Driving Course – Completing a class that teaches safe driver techniques may get you a small discount depending on where you live.

- Payment Method – If you pay your bill all at once as opposed to paying monthly you could save up to 5%.

- Sign Online – Some of the larger companies will provide an incentive for buying your policy on your computer.

- Save over 55 – Older drivers may receive reduced rates.

- Discounts for Safe Drivers – Drivers who avoid accidents may save up to 50% more than drivers with accidents.

Discounts save money, but please remember that most discount credits are not given to the whole policy. A few only apply to individual premiums such as collision or personal injury protection. So when the math indicates it’s possible to get free car insurance, you aren’t that lucky.

Companies and some of the premium reductions they offer include:

- State Farm policyholders can earn discounts including good student, multiple policy, accident-free, good driver, Drive Safe & Save, multiple autos, and driver’s education.

- Farmers Insurance has savings for bundle discounts, youthful driver, homeowner, teen driver, and pay in full.

- Progressive offers premium reductions for continuous coverage, online quote discount, homeowner, good student, multi-policy, and multi-vehicle.

- GEICO offers discounts for federal employee, membership and employees, driver training, daytime running lights, air bags, emergency military deployment, and military active duty.

- Auto-Owners Insurance discounts include safe vehicle, anti-lock brakes, mature driver, multi-policy, multiple vehicles, and student away at school.

- The Hartford may offer discounts for good student, defensive driver, air bag, driver training, bundle, vehicle fuel type, and anti-theft.

- Farm Bureau includes discounts for good student, multi-policy, renewal discount, youthful driver, 55 and retired, and safe driver.

- USAA may include discounts for safe driver, new vehicle, defensive driver, military installation, vehicle storage, and multi-vehicle.

If you want the cheapest Pontiac G5 rate quotes, ask all the companies how you can save money. Savings might not be offered in every state. To locate insurers that offer multiple discounts in Ohio, click here to view.

Neighborhood agents and auto insurance

Many drivers just want to talk to a local agent. A good thing about getting free rate quotes online is the fact that you can find cheaper rates but also keep your business local.

By using this form (opens in new window), your insurance coverage information is immediately sent to local insurance agents in Columbus who want to provide quotes for your coverage. There is no need to do any legwork because quoted prices will be sent to you. You’ll get the best rates without a big time investment. In the event you want to get a rate quote for a specific company, just search and find their rate quote page to submit a rate quote request.

By using this form (opens in new window), your insurance coverage information is immediately sent to local insurance agents in Columbus who want to provide quotes for your coverage. There is no need to do any legwork because quoted prices will be sent to you. You’ll get the best rates without a big time investment. In the event you want to get a rate quote for a specific company, just search and find their rate quote page to submit a rate quote request.

Picking the best insurer requires you to look at more than just a cheap quote. Below are some questions you should ask.

- Will the quote change when the policy is issued?

- How does the company pay claims for a total loss?

- Does the company have a local claim office in Columbus?

- What companies can they write with?

- Are there any hidden costs in their price quote and does it include driving and credit history?

- Is vehicle mileage a factor when determining depreciation for repairs?

- Do they make recommendations based only on price?

If you are wanting to purchase auto insurance from a reputable agency, it’s important to understand the different agency structures and how they are distinctly different. Agencies in Columbus are either independent agents or exclusive agents.

Exclusive Insurance Agencies

These agents can only provide pricing for a single company and some examples include State Farm, AAA, Farmers Insurance or Allstate. They generally cannot provide prices from multiple companies so always compare other rates. These agents are highly trained on the products they sell which helps them sell on service rather than price.

Below are exclusive insurance agencies in Columbus who can help you get price quotes.

Gary Snowden – State Farm Insurance Agent

1369 Georgesville Rd – Columbus, OH 43228 – (614) 272-2300 – View Map

Gary Bepler – State Farm Insurance Agent

3246 Noe Bixby Rd – Columbus, OH 43232 – (614) 837-4379 – View Map

American Family Insurance – Yelena Uchiteleva Agency LLC

233 S Hamilton Rd – Columbus, OH 43213 – (614) 235-1702 – View Map

Independent Agents (or Brokers)

Agents of this type often have affiliation with several companies and that enables them to quote your coverage with many different companies and get the cheapest rates. If they find a cheaper price, they simply move the coverage in-house and you won’t have to switch agencies. When comparison shopping, we recommend you include multiple independent agents to ensure the widest selection of prices.

Listed below is a short list of independent insurance agencies in Columbus willing to provide price quotes.

Associated Insurance Agency – Pickerington

12927 Stonecreek Dr – Pickerington, OH 43147 – (614) 866-6060 – View Map

Augustine Insurance Agency

3851 N High St – Columbus, OH 43214 – (614) 267-1973 – View Map

IHT Insurance Agency Group LLC

655 Metro Pl S Suite 330 – Dublin, OH 43017 – (614) 761-2825 – View Map

Cheap insurance premiums are out there

In this article, we presented quite a bit of information on how to compare Pontiac G5 insurance rates in Columbus. The most important thing to understand is the more you quote Columbus auto insurance, the higher the chance of saving money. You may even be surprised to find that the lowest priced insurance comes from a small mutual company. Smaller companies may have significantly lower car insurance rates on certain market segments than their larger competitors like Allstate and Progressive.

Cheaper insurance in Columbus can be sourced online in addition to many Columbus insurance agents, and you need to price shop both to have the best chance of lowering rates. Some insurance providers do not offer online quoting and most of the time these small, regional companies only sell coverage through independent insurance agents.

More information

- Should I Buy a New or Used Car? (Allstate)

- Who Has Affordable Columbus Car Insurance Quotes for Single Moms? (FAQ)

- What Auto Insurance is Cheapest for Uber Drivers in Columbus? (FAQ)

- Who Has Cheap Car Insurance Rates for a Learners Permit in Columbus? (FAQ)

- Who Has Cheap Auto Insurance Rates for Ride Shares in Columbus? (FAQ)

- Child Safety Seats (Insurance Information Institute)

- Young Drivers: The High Risk Years Video (iihs.org)